The Slipstream Strategy

When at risk of being disrupted, should you compete or cooperate?

Platform Papers is a blog about platform competition and Big Tech. The blog is linked to platformpapers.com, an online repository that collects and organizes academic research on platform competition.

Written by Alexander Engelmann, Georg Reischauer, Annabelle Gawer, and Werner H. Hoffmann.

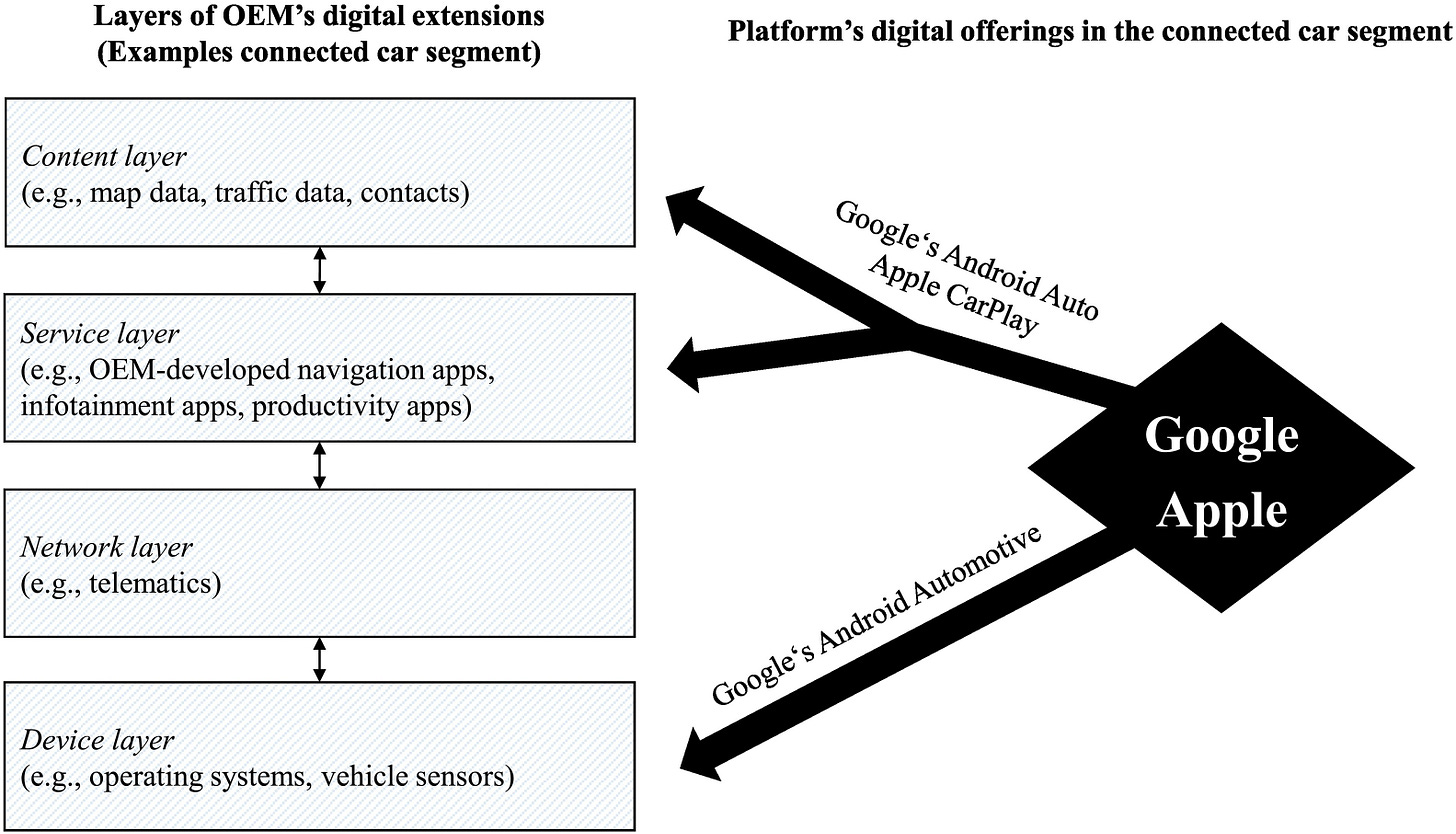

In recent years, Big Tech companies have leveraged their platforms to enter multiple established industries, including health care, education, and automotive. And, on their quest for “digital colonialization”, they are hungry for more. The entry of Tech Giants is a particular challenge for digital services of incumbent firms, putting them at risk of being disrupted. For instance, soon after Google and Apple launched free apps (Android Auto and Apple CarPlay) that allow smartphone users to mirror many apps and their personalized content on a car's dashboard information and entertainment head unit, the WSJ noted “the next big battle between Google and Apple is for the soul of your car.”

Now, how should incumbents respond when Big Tech launches offerings that threaten incumbent offerings? Should they compete or cooperate?

The Slipstream Strategy

Our research that analyzed the evolution of the digital services of a premium carmaker in the aftermath of the launch of Android Auto and Apple CarPlay provides an answer: pursue what we call the slipstream strategy. It consists of two phases. First, focus on cooperating with the platform, thereby capitalizing on the “digital airflow” that the platform creates. After having profited from this cooperation, “move out of the windbreak” and focus on competing with the platform on the quality of those digital services that platforms seek to disrupt.

The implementation of the slipstream strategy is linked to the structure of digital services, also referred to as digital extensions of incumbents’ products (like cars). In essence, digital services consist of four layers: 1) The device layer refers to hardware components like sensors and their operating system; 2) the network layer consists of connectivity modules to connect the component with external networks; 3) the service layer is the customer-facing app that enables to use the component in a value-adding way; and 4) the content layer encompasses dynamic real-time data that feeds in into the app (also see image below). Google’s and Apple’s car-related apps target the first two layers. With Android Automotive, Google also targets the device layer of incumbents’ digital services.

The slipstream strategy involves two distinct phases in which different layers are targeted: competitive cooperation and cooperative competition.

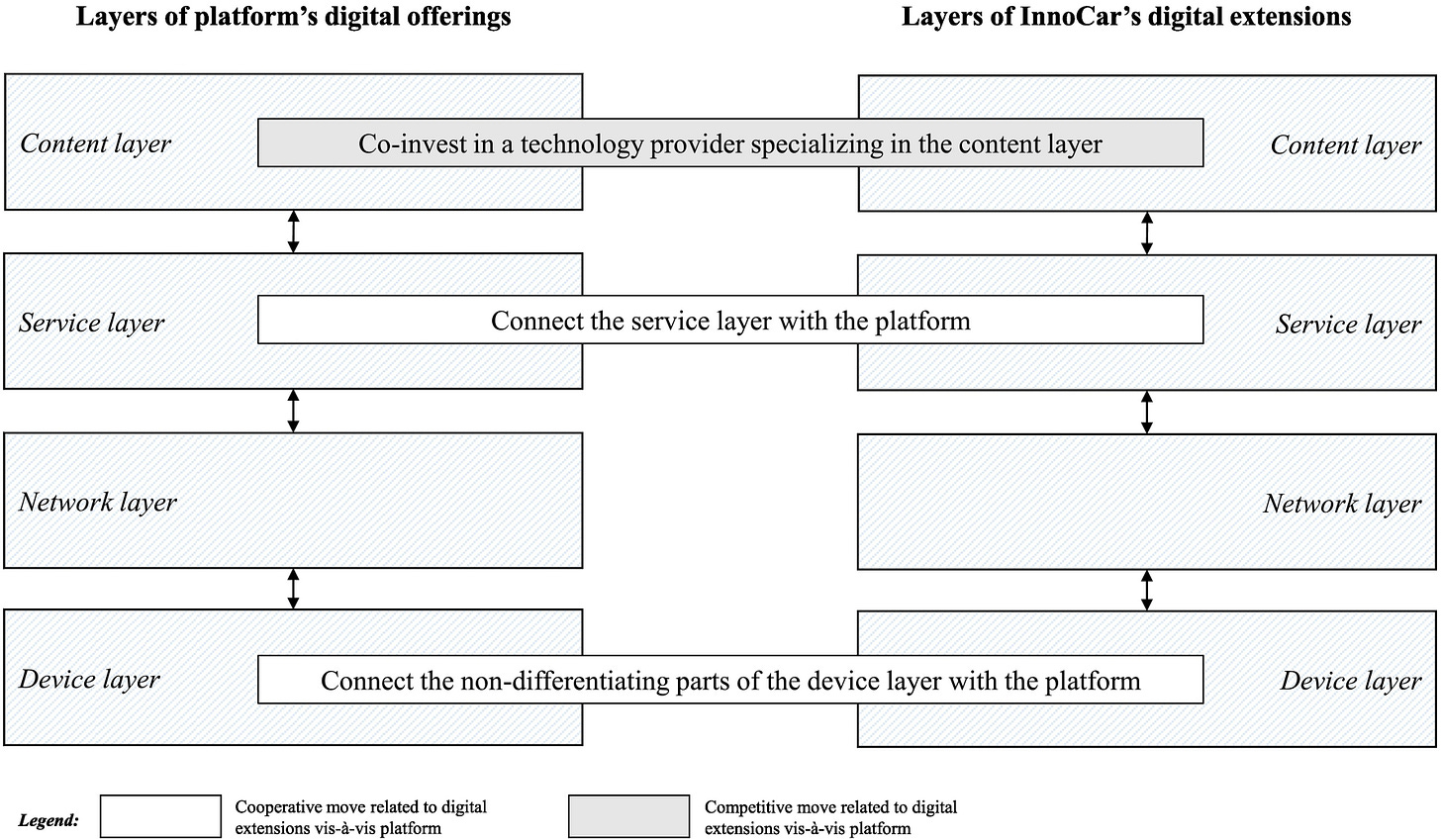

Phase 1: Competitive cooperation

In the competitive cooperation-phase (see figure below), incumbents should allow customers to choose whether they want to use their own digital extensions or those of the entering platforms. In our study, the carmaker allowed the entrants’ apps to be mirrored onto its cars’ dashboards. At the same time, incumbents should strive to establish complementary assets that are key to better understanding customer preferences and that are not at the heart of the incumbents’ positioning. In our study, these were mapping technologies and digital services (like infotainment apps). Alongside the data-sharing infrastructure and increased digital service availability identified in our study, another shared complementary asset that might be important for standing up against platforms is regulatory expertise, which can be executed in the form of combined lobbying efforts.

In addition, incumbents should consider investing in technology providers that are key for their digital extensions. The carmaker we studied, for example, co-invested with rival carmakers that were also targeted by platforms in a technology provider specialized in digital maps and other location technologies. However, it is also important to selectively cooperate with platform entrants at the same time. Reaching out and giving platforms restricted access to parts of digital extensions that are not key to differentiate is especially important to understanding customer preferences, given that digital extensions are typically not the core business of an incumbent.

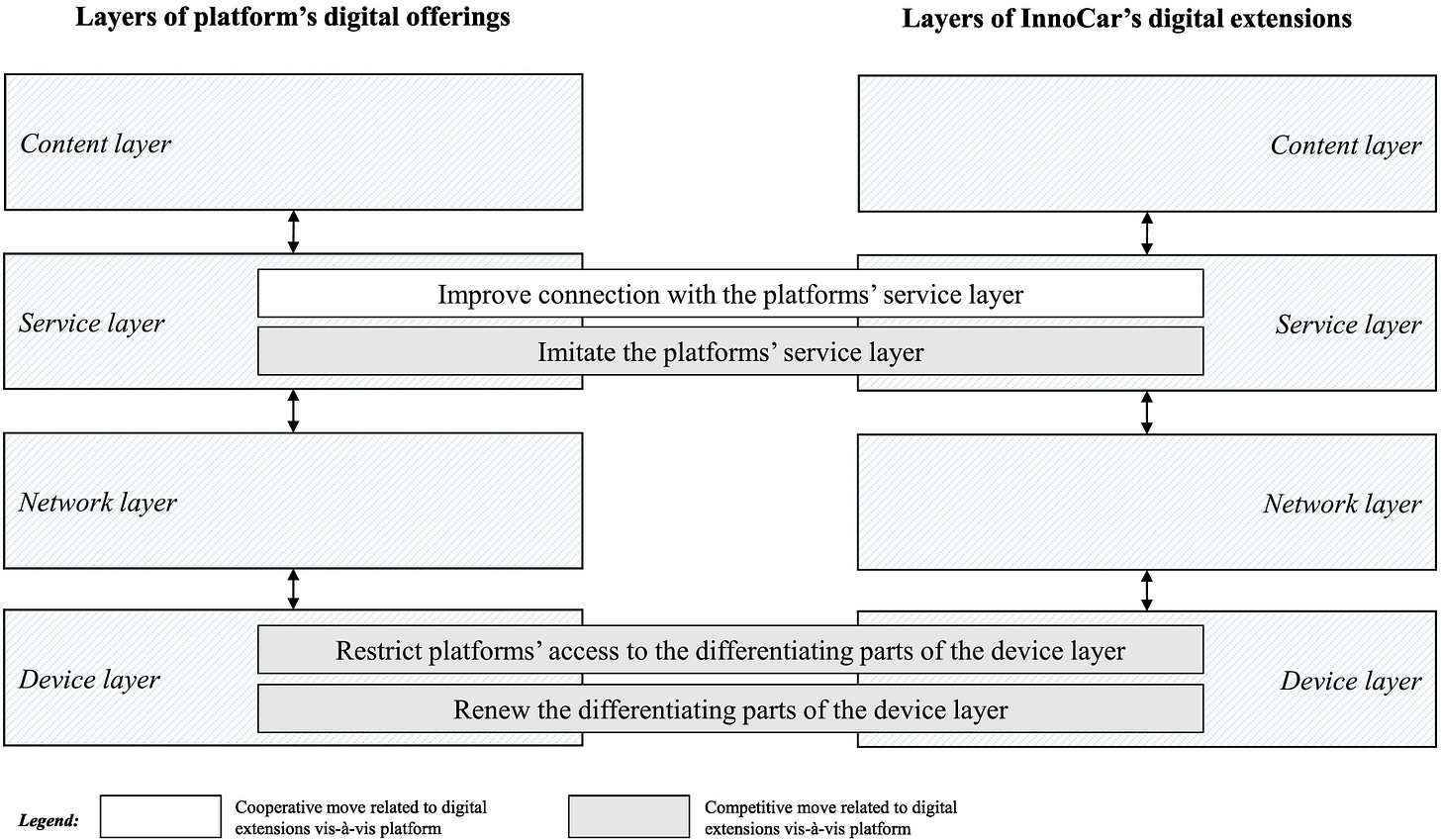

Phase 2: Cooperative competition

In the cooperative competition-phase (see figure below), after complementary assets have been established, the slipstream strategy suggests accentuating competition with platforms. The overarching rationale is to compete with platforms on the quality of digital extensions. To that end, incumbents should concentrate on innovating their digital extensions by imitating the usability of platforms’ offerings. The other way to innovate is to launch new digital extensions in areas where these extensions can offer more value than the platforms’ offerings (which is often not the case, such as in music or office applications). That said, managers should protect those layers of their digital extensions that are unexplored but have the potential to enrich their physical products in a differentiating way. For example, the automaker in our study restricted access to key hardware (like sensors and other modules) and corresponding data so that it could develop more reliable routing information (including road hazards and weather conditions) which helped to differentiate from Google Maps. In doing so, incumbents should avoid the trap of defending all the layers of their digital extensions and finding themselves spread too thin. This implies that managers should not strive to modularize their digital extensions entirely, as this could make it easier for platforms to offer substitutions on each layer, sometimes even for free (such as in the case of Android Auto and Apple CarPlay for car infotainment or Android Automotive for car OS).

At the same time, incumbents are advised not to cut all ties with platforms but cooperate with them on less differentiating digital extensions (e.g., apps for opening and closing car doors). To provide customers with state-of-the-art usability and content and to give them a choice between their own digital extensions and the platforms’ substituting digital offerings, incumbents should consider improving the connection between the two.

In conclusion

To counter potential disruption of ones’ digital services by Big Tech, we recommend pursuing the slipstream strategy. Its key takeaway? Cooperate when necessary, but always be ready to innovate and compete when there is high value capture potential linked to your products.

This blog is based on Alexander, Georg, Annabelle, and Werner’s research, which is published in Research Policy and is included in the Platform Papers references dashboard:

Reischauer, G., Engelmann, A., Gawer, A., & Hoffmann, W. H. (2024). The slipstream strategy: How high-status OEMs coopete with platforms to maintain their digital extensions' edge. Research Policy, 53(7), 105032.

Platform Papers is curated and maintained by Joost Rietveld.