Platform Papers is a blog about platform competition and Big Tech. The blog is linked to platformpapers.com, an online repository that collects and organizes academic research on platform competition.

By Kaushik Gala, Andreas Schwab, and Brandon Mueller.

Platforms like Amazon, Etsy, and Instagram have become hotbeds for entrepreneurial activity. These platforms have given rise to a new breed of entrepreneurs who reach global audiences. However, did you know that most such digital-platform entrepreneurs experience only mediocre success while some vastly outperform them? Such ‘star entrepreneurs’ often achieve 10, 100, or even 1000 times better performance than their average peers.

Average Versus Star Entrepreneurs

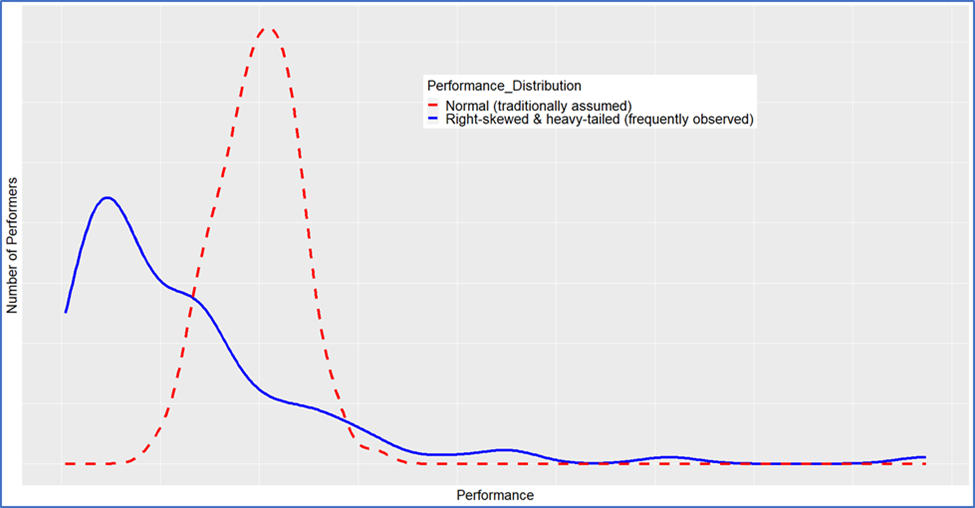

Most entrepreneurship research assumes that entrepreneurial performance follows a normal distribution. This implies that the performance of most entrepreneurs clusters around the average, with extreme successes or failures being rare outliers. In reality, however, we observe star performers in most settings. For example, the Inc. 5000 list of fastest-growing firms in the US includes those whose revenue growth rates are orders of magnitude higher than those of most small businesses in America. Even within this list, the best-performing ventures outperform their peers by over a thousand-fold. For example, the fastest-growing firm had a three-year revenue growth rate of 90,779% versus less than 1000% for the median firm and only 72% for the slowest-growing firm in the 2024 edition of the Inc. 5000 list.

Thus, the actual distribution of entrepreneurial performance is far from symmetrical and normal (dashed red line). Instead, it is significantly skewed to the right and has a ‘heavy tail’ constituted by star entrepreneurs (solid blue line).

Digital Platforms Amplify Star Performance

To understand how and why such star performance is persistent, we found digital platforms to be an ideal study setting. Several key characteristics of platforms are thought to increase the extremity of star performance and the speed with which it can be achieved. First, digital goods such as images and videos have near-zero marginal costs; once digital content is created, it can be quickly distributed to millions of users at virtually no additional cost. Even physical goods benefit because customers can more easily find, evaluate, purchase, and return such goods through digital marketplaces. The ratings, reviews, and recommendations customers post can create a virtuous cycle for digital platform entrepreneurs, driving more visibility and sales. As more buyers, and eventually more sellers, join a platform, its value increases for all participants, further amplifying the success of star entrepreneurs.

[W]hile the average annual income of an instructor on the Udemy platform is less than $3,000, dozens of instructors earn more than $1 million annually.

In our study published in the Journal of Business Venturing, we chose the Udemy.com global learning platform to study star entrepreneurs. Udemy connects tens of thousands of instructors with millions of students worldwide. Udemy instructors (i.e., digital platform entrepreneurs) sell recorded videos to their customers, some of whom rate and review these digital products. Udemy.com is an environment where success can compound rapidly, leading to the emergence of star entrepreneurs. Indeed, while the average annual income of an instructor on the Udemy platform is less than $3,000, dozens of instructors earn more than $1 million annually.

Distribution of Entrepreneurial Performance

Our analysis of 11,937 instructors shows that the lognormal—not the normal—distribution best describes the distribution of entrepreneurial performance on Udemy. Not only does this finding provide empirical evidence of star performance, but it also provides a more accurate model for understanding and predicting the extent by which ‘the best’ entrepreneurs outperform ‘the rest’. Because lognormal distributions arise from multiplicative effects instead of additive effects, our study points to the intriguing possibility that one or a few key aspects of platforms and entrepreneurs can significantly amplify the odds and extremity of performance.

We also examined the differences in performance distributions across product domains on Udemy.com. We found, for example, that performance was far more skewed in the software domain than in the fashion domain. In other words, star performers outperform their peers to a much larger extent in domains that require more cognitive engagement and expertise from entrepreneurs and customers than in those that required less.

About the research: In our sample of 11,937 digital platform entrepreneurs, we found that the top 7 % of entrepreneurs accounted for about 80 % of performance. Importantly, we found that the accumulation rate of performance—not only its initial value—influences eventual outcomes on such platforms, implying that aspiring stars can potentially catch up with incumbent stars. We also found that the outperformance by star entrepreneurs was stronger in product domains with high knowledge intensity (i.e., those that involved higher levels of complexity, information processing, problem-solving, skill, and specialization).

Implications for Entrepreneurs

Our findings have several implications for digital platform entrepreneurs. While many may instinctively recognize the disparity in performance in a market, they are likely unaware of the extremity of star performance vis-à-vis median performance. Those who are late entrants but have the ability and motivation to pursue such outperformance would be well advised to focus on the growth rate and seek advantage of the interaction between the key characteristics of digital platforms.

For example, aspiring stars should consider not only promptly evaluating and responding to customer reviews but also providing incentives for new ratings and reviews to leverage the feedback loops on digital platforms into a higher accumulation rate of performance. Similarly, entrepreneurs’ decisions about market entry, product development, and scaling ought to consider the knowledge intensity of the product domain as a salient factor.

Implications for Platform Owners

Platform owners are likely aware that a small minority of entrepreneurs on their platforms generate a disproportionate amount of value. However, the extent to which this varies across domains and over time can help them address the tradeoff between value creation and appropriation. Furthermore, platform owners can proactively monitor growth rates in emerging product domains and modify their governance and promotion policies accordingly. For example, in less than 2 years, ChatGPT emerged as one of the fastest-growing and largest course topics on Udemy.com, with the broader set of Generative AI topics now featuring prominently in the platform’s marketing strategies.

[W]hile star entrepreneurs can drive significant value, platform owners should also seek to maintain diversity and fairness in the ecosystem to ensure aspiring stars continue to join the platform.

Conversely, while star entrepreneurs can drive significant value, platform owners should also seek to maintain diversity and fairness in the ecosystem to ensure aspiring stars continue to join the platform and thus ensure the availability of a variety of offerings to the end customers. Because incumbent stars may be unwilling or unable to engage with new and fast-growing market opportunities, platform owners can implement features that allow other entrepreneurs to easily scale their offerings and emerge as the next generation of stars.

This blog is based on research published in the Journal of Business Venturing, which is included in the Platform Papers references dashboard:

Gala, K., Schwab, A., & Mueller, B. A. (2024). Star entrepreneurs on digital platforms: Heavy-tailed performance distributions and their generative mechanisms. Journal of Business Venturing, 39(1), 106347.

Platform Updates

Platform Papers has published a few other blogs on platform-dependent entrepreneurship in different settings including apps, video games, music streaming, and crowdfunding. Happy reading!

Intel’s fresh blood triggers market optimism($) - Veteran dealmaker Lip-Bu Tan’s appointment sends shares climbing as investors welcome new direction. Leadership change follows growing doubts about Gelsinger’s costly foundry expansion strategy against TSMC (also see: What Intel’s New CEO Needs to Catch Up to Nvidia, TSMC and Others).

Meta bets on crowd wisdom for content policing - Social giant rolls out Community Notes-style system across its platforms after abandoning professional fact-checking. The approach rewards cross-viewpoint consensus while raising questions about response time and effectiveness.

Apple’s M-Series advantage awaits AI action - Custom silicon creates unique opportunity as web apps diminish software differentiation value. Rather than building everything in-house, Apple can empower developers with guaranteed AI model performance—turning its custom chip advantage into an ecosystem-wide moat.

DeepSeek fever sweeps Chinese corporate landscape - Companies from gaming to nuclear energy race to integrate homegrown AI, boosting stock prices. The affordable open-source solution satisfies both practical needs and patriotic sentiment in perfect market timing.

Walmart’s brick-and-mortar arsenal challenges Amazon($) - Retail veteran weaponizes 4,700 stores via Spark delivery to reach 93% of US households with same-day service. Strategy attracts higher-income shoppers through essential goods and premium offerings, shifting e-commerce market share.

Streaming giants mine YouTube gold rush($) - Major platforms court online creators and their audiences following Amazon’s “Beast Games” success. The strategy demonstrates online-to-streaming potential while creators voice control concerns.

Stablecoin titans lock horns amid regulatory spotlight - Presidential crypto push intensifies $3T battle between Tether’s Devasini and Circle’s Allaire. The dollar-pegged competition transcends market share to existential survival as new frameworks emerge.

Platform Papers is published, curated and maintained by Joost Rietveld.